The Blue Economy as a territorial growth driver

WHAT IS THE BLUE ECONOMY: SECTORS AND COMPANIES INVOLVED IN ITALY

The Blue Economy represents an extremely diverse sector, which includes companies of varying sizes and in different segments. This area includes all economic activities related to seas and oceans, including sectors directly involved in or near a marine environment, such as shipbuilding, port activities, maritime transport, beach tourism, fishing and aquaculture. In Italy, the companies involved extend across all regions and number over 227,000 units; this figure from 2023 recorded +4.3% growth compared to 2019, thus representing a dynamic and growing business.

KEY FIGURES OF THE BLUE ECONOMY IN ITALY AND ITS ECONOMIC IMPACT

At European level (EU27), the Sea economic sector produces added value of over EUR 170 Bn, employing 3.6 million people across all its supply chains. EUR 18.7Bn was generated in imports-exports.

In Italy, the most recent data shows the sector impacting on the economy for EUR 64.6Bn in added value, about 10.2% of the national total, and a multiplier of 1.8; in other words, one euro produced by the Sea economy activates another 1.8 for the rest of the economy.

It is an effective development driver as it serves those strategic assets that influence our country’s competitiveness such as, for example, the internationalisation of the industrial system and tourism.

BUSINESSES AND STRATEGIC SECTORS WITH HIGH ADDED VALUE IN ITALY

At the level of Italy's Macro-Areas, the South has the largest number of companies with over 111,000 units (48.9% of Italy’s total), followed by Central Italy with over 58,000 units, with the rest distributed between the North East and North West.

If we consider individual regions, the Top 5 are Liguria, Sardinia, Sicily, Lazio and Marche, representing more than 35% of the country’s total. The two leading provinces in terms of the volume of companies are Rome (29,000 units) and Naples (23,000 units).

In addition, it is worth noting the significant presence of young companies1, over 20,000 units, of which 11,000 are in Southern Italy, and the number of women-run businesses at over 51,000, of which 26,000 are based in Southern Italy.

In terms of added value produced, there are 3 sectors of note: accommodation and catering services (EUR 18.5 Bn), maritime transport of goods and passengers (EUR 12.7 Bn) and shipbuilding (EUR 8.7 Bn). Our country has companies of superior excellence in these three areas, for example large-scale shipowners and operators in shipbuilding (shipyards).

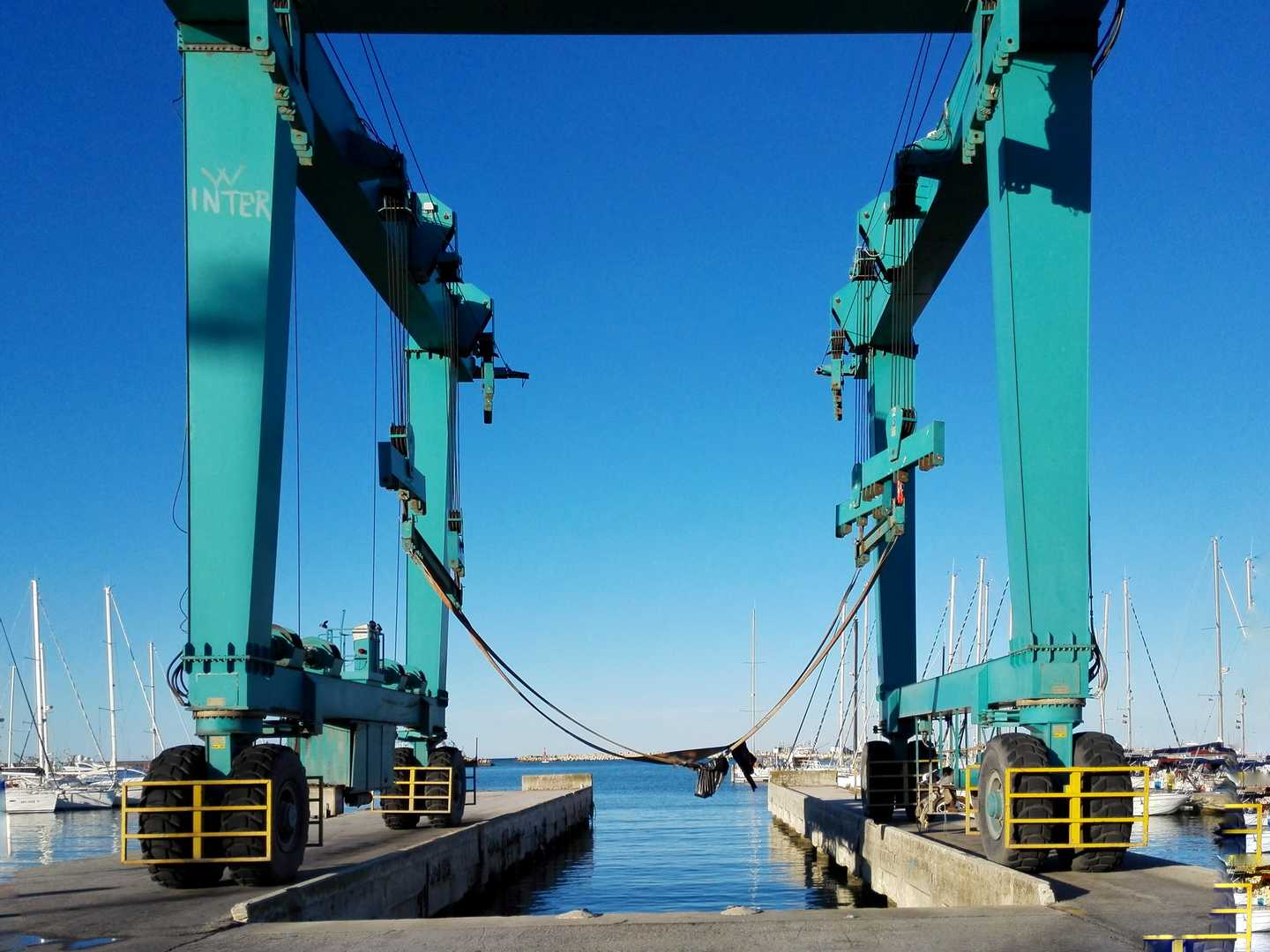

PORT INFRASTRUCTURE AT THE HEART OF THE SEA ECONOMY

The Sea economy impacts infrastructure, first and foremost the ports, a fundamental link in the logistics and tourism chain, maritime development hubs that host companies of all types and sizes, such as terminal operators, shippers, shipping agents, customs, intermodal operators that move goods from ship to train and the shipping companies operating in the commercial and passenger sector (ferries and cruises).

THE ITALIAN PORT SYSTEM

The Italian port system is also complex and well-structured and has adopted the multipurpose model, namely, a model that makes it possible to handle all types of goods, from containers to dry bulk (cereals, metals), from liquid bulk (oil and chemicals) to Ro-Ro (ships carrying trucks and motor vehicles). Only the port of Gioia Tauro clearly dominates the container sector, representing Italian excellence, and hosting large ships that sail the transoceanic routes to the Far East and the Americas.

The latest study carried out by Assoporti (an association that groups together all the ports in Italy) and SRM (Research Centre connected to the Intesa Sanpaolo Group) shows that in 2024, freight traffic was at over 480 million tonnes (+0.7% compared to the previous year), with almost 60 million ferry passengers and 13,8 million cruise passengers.

DIGITALISATION AND SUSTAINABILITY IN PORTS: THE CHALLENGE OF NPRR INVESTMENTS

This infrastructure is now facing the great challenge of public investments (as NRRP), which amount to more than EUR 12Bn to modernise and consolidate ports2; specifically, these include digitalization and sustainability projects that will contribute significantly to supporting the decarbonisation process of the entire maritime sector as a whole and to increase Italy competitiveness in the Mediterranean.

Figures in this article are taken from the Report on the Economy of the Sea – Unioncamere Tagliacarne 2024, unless otherwise indicated.

1 Companies with a control and ownership share held mainly by people under the age of 35.

2 Infrastructure attachment to 2025 DEF